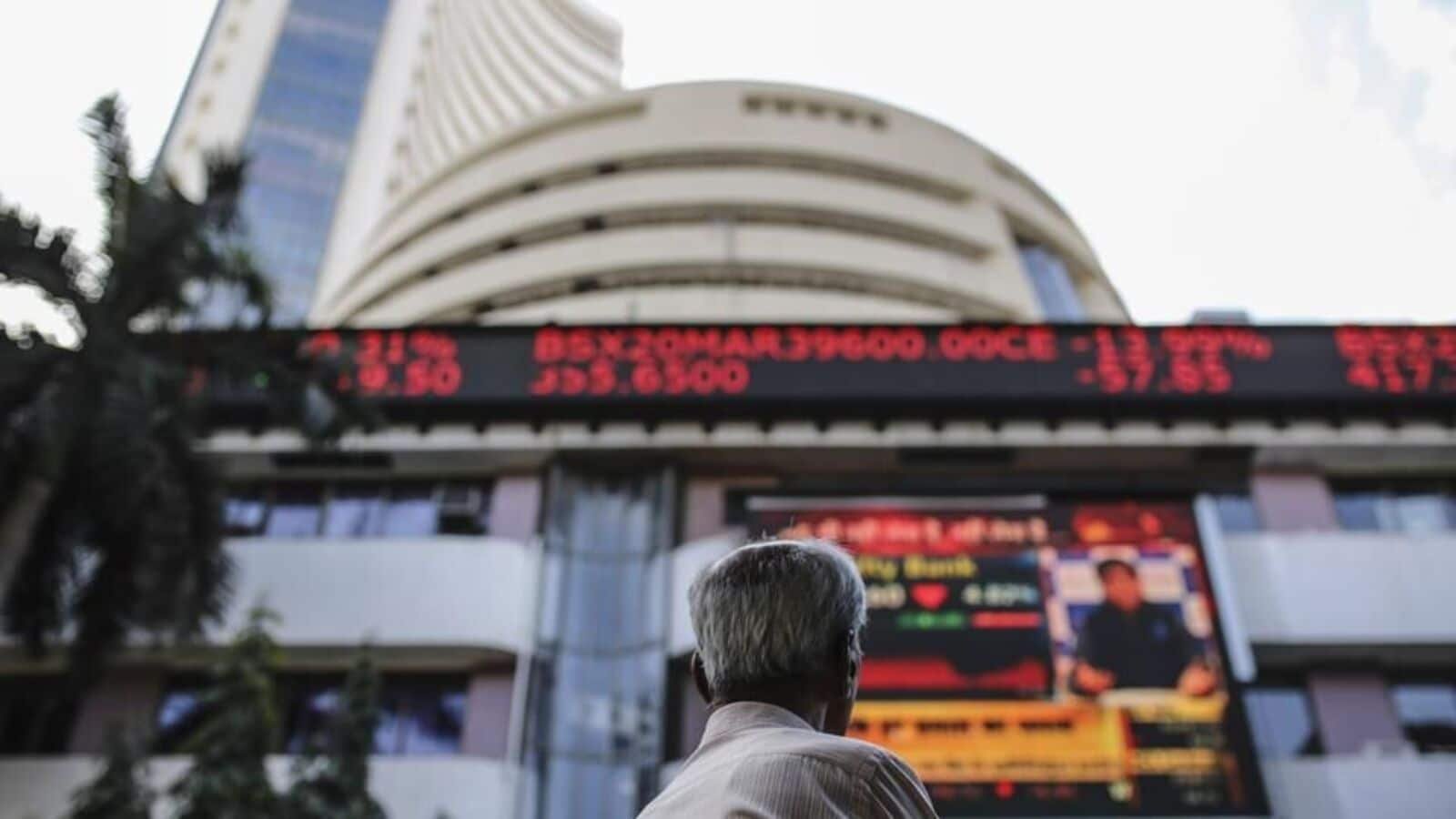

Indian stock market today: The Indian markets ended in the red on the last trading day of October, as well as Samvat 2080, as festive cheer was amiss on Dalal Street. A sharp sell-off in IT and FMCG stocks pulled the front-line indices lower while support from the pharma sector capped the losses.

Consequently, the Nifty 50 concluded Thursday’s session, with a 0.56% decline, settling at 24,205, while the Sensex dropped by 0.70% to finish at 79,386. Meanwhile, the broader market displayed mixed performance, as the Nifty Midcap 100 index tumbled 0.40%, whereas the Small Cap 100 index gained over 1.15%.

Among the sectoral indices, the Nifty IT index faced a significant downturn, plunging by 3.03%. All constituents of the index ended in the red following Capgemini’s earnings report, which revised its revenue growth estimates lower for the year ending in December, adversely impacting investor sentiment towards the IT sector. The index concluded October with a total drop of 3.67%.

After a brief rally in recent sessions, the Nifty FMCG index also came under considerable selling pressure, ending today’s trade with a cut of 1%. It wrapped up October with a substantial decline of 10%, marking its largest monthly drop in the past six years.

On the other hand, banking stocks continued their weak performance for the second consecutive trading session, with the Nifty Bank losing another 0.64% after a 1% drop in the previous session, culminating in a 2.84% decline for October.

In contrast, Nifty Pharma concluded the day with a robust gain of 1.61%, driven primarily by Cipla, which surged nearly 9.5%. However, the index finished October in negative territory, recording a drop of 2.34%.

Nifty 50 tumbles over 6% in October

The Nifty 50 concluded October with a notable drop of 6.22% to 24,205, marking its largest monthly decline since March 2020, when it plummeted 23.25% amid the COVID-19 pandemic. This sell-off has led the index to correct 8% from its peak of 26,277, reached in late September.

Dr V K Vijayakumar, Chief Investment Strategist, at Geojit Financial Services, said, “India’s underperformance is driven by lofty valuations, relentless FII selling, and concerns over slowing earnings growth. In the near term, this scenario is unlikely to change, reversing the trend decisively, even though mild pullbacks are possible.”

“A significant trend in the market is the strong stock-specific action. Better-than-expected results are responded to with sharp moves up to 20% a day, while worse-than-expected results are met with around 15% correction. This trend of strongly rewarding good results and punishing poor results equally strongly is a reflection of the focus on stock-specific action rather than the focus on the benchmark indices and market as a whole. Given the elevated valuations and the possibility of continuing FII selling, stocks and sectors that have delivered good results and good guidance are likely to remain resilient. Investors should focus on these segments,” he further added.

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of Mint. We advise investors to check with certified experts before making any investment decisions.